What is a Government Shutdown and Why Does It Happen?

A government shutdown occurs when Congress fails to pass legislation that provides funding for federal agencies and programs. Most government operations rely on annual appropriations bills, which must be approved by Congress and signed by the President before the start of the new fiscal year on October 1. If these bills, or a temporary funding measure called a continuing resolution, are not enacted in time, many federal agencies must suspend non-essential activities until funding is restored. Essential services, such as national security, air traffic control, and certain health and safety functions, continue to operate, as do programs funded through mandatory spending like Social Security and Medicare.

How Common Are Shutdowns and What is Their Economic Impact?

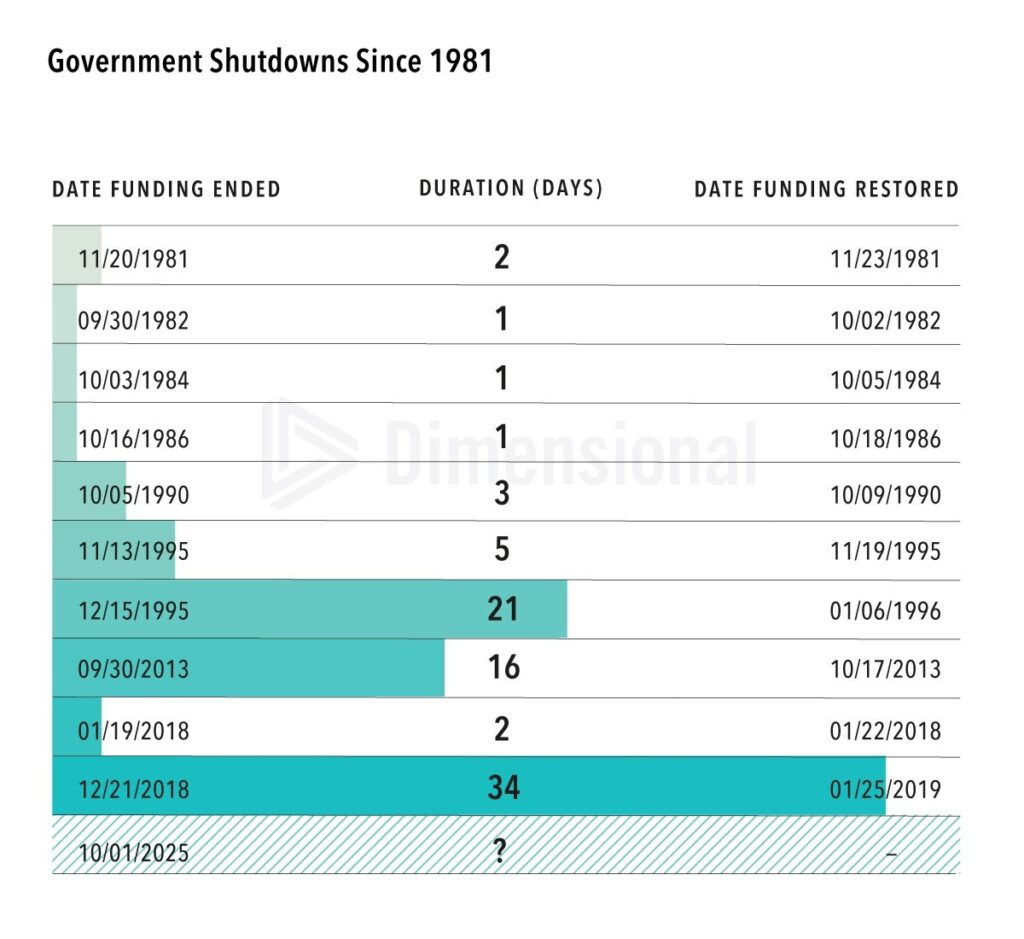

Shutdowns are not rare in U.S. history. Since the 1970s, there have been 21 shutdowns, most lasting only a few days. The longest episodes include:

- December 22, 2018 to January 25, 2019: 34 days (President Trump)

- December 16, 1995 to January 6, 1996: 21 days (President Clinton)

- October 1 to 17, 2013: 16 days (President Obama)

Although disruptive, shutdowns have historically had limited economic impact. The Congressional Budget Office estimated that the 2018–2019 shutdown permanently reduced GDP by about $3 billion dollars, even though most of the lost output was eventually recovered. Longer shutdowns can also delay the release of key economic data that can provide insights about the health of the U.S. labor market, inflation, and consumer spending, which can complicate Federal Reserve policy decisions and impact markets.

How Do Markets Respond and What Does It Mean for Investors?

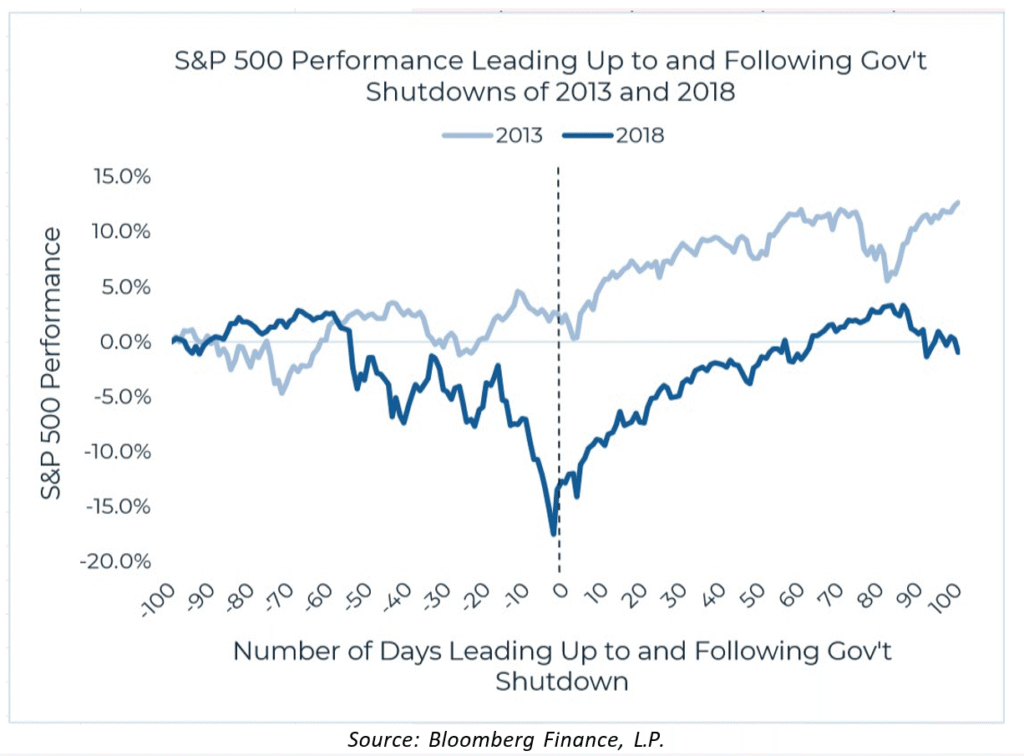

Financial markets generally treat shutdowns as short-term political events rather than fundamental economic shocks, and so far that is what we are seeing today. Historically, brief shutdowns showed little effect on corporate earnings or long-term equity performance. For example, during the 2013 and 2018 shutdowns, the S&P 500 rose strongly in the 100 days following the shutdown. The 2018 shutdown coincided with a broader market correction unrelated to the funding lapse, and stocks rallied while the government was still closed.

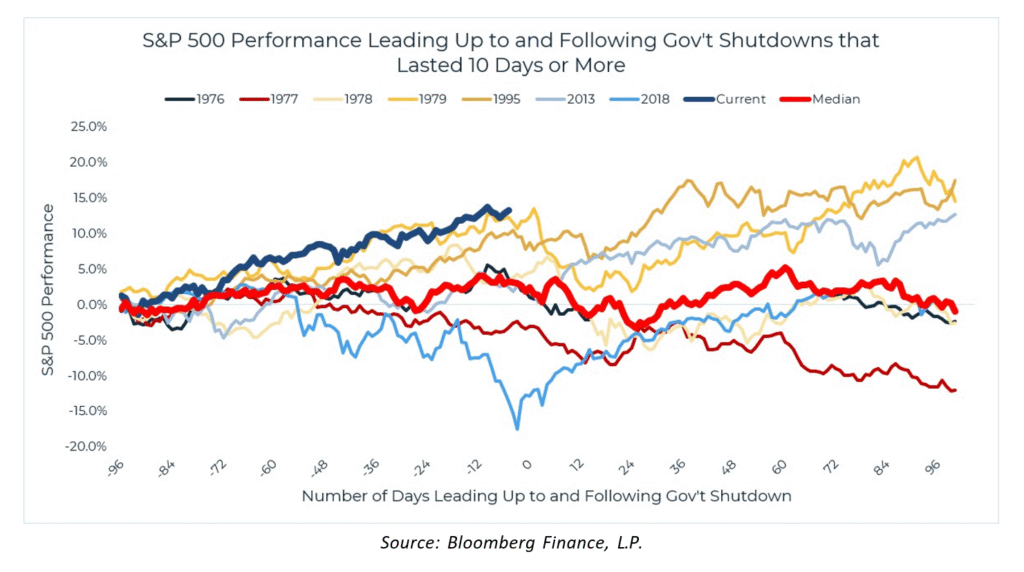

Even for shutdowns lasting more than 10 days, history shows that government shutdowns have had limited long-term impact on equity markets. The S&P 500’s median performance during past extended shutdowns remained relatively stable. Market outcomes are typically driven more by fundamentals, such as corporate earnings and overall economic strength, than by political gridlock.

Bond markets usually remain steady during shutdowns because the Treasury continues to make interest payments and conduct auctions. However, heightened economic and policy uncertainty could change that dynamic. While history shows yields often decline during shutdown periods, concerns about political risk and fiscal conditions might put upward pressure on Treasury yields this time.

Current Context and Guidance

The U.S. government entered a partial shutdown on October 1, after Congress was unable to reach an agreement on funding legislation. While government shutdowns are not uncommon, this one has drawn more attention than usual because of guidance from the White House instructing some federal agencies to make permanent workforce reductions—a step that adds pressure to ongoing negotiations.

Historically, shutdowns have had limited long-term impact on the economy or markets, though short-term disruptions can occur. The most immediate effect is the delay of key economic reports, including employment and inflation data. These reports help guide decisions by the Federal Reserve and market participants, so their absence may add some uncertainty in the near term.

As the government shutdown enters its third week, we continue to monitor developments and assess potential implications for investors. While headlines may drive short-term market volatility, our long-term focus and diversified investment approach remain well suited to navigating periods of uncertainty.

Source: Fiducient Advisors

Heritage Financial CIO, Bob Weisse, and CEO, Sammy Azzouz, discuss the government shutdown and more on our Wealthy Behavior podcast.