Though still hot, the labor market is starting to cool, albeit slightly. Notable companies including Meta, Microsoft, Alphabet, Amazon, and Goldman Sachs recently announced large layoffs. Though many of the announcements have come from companies in the tech sector, a slowing economy, growing fears of a recession, and a Fed that remains focused on fighting inflation means companies in other industries will likely soon follow suit.

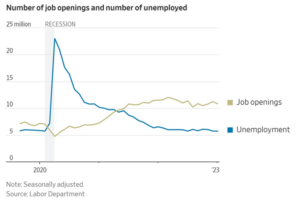

The Fed’s goal is to have a Goldilocks labor market – not too hot, not too cold. One sign of a stable, healthy labor market is when the number of job openings and the number of those unemployed are in equilibrium, which is not the case today. Currently there are approximately 5 million more job openings than people seeking employment.

The Fed has made it clear that they are focused on restoring balance to the labor market. We expect them to continue tightening conditions until the number of job openings decrease and the number of people looking for work (unemployment) increases. In fact, the Fed has forecasted unemployment will increase to 7.5 million (4.55%) by the end of 2023. That equates to more than 2 million jobs eliminated over the next 8 months.

What Should You Do If You Lose Your Job?

Here are answers to the questions we get asked most often.

What should I do about health care coverage?

If you lose your job, you may be eligible for COBRA coverage. COBRA is a federal law that allows you to continue your employer-sponsored health insurance for a limited period of time after you lose your job. Under COBRA, you are typically eligible to continue your employer-sponsored health insurance for up to 18 months after you lose your job. However, if you qualify for an extension due to certain circumstances, such as disability or the death of the covered employee, you may be able to extend your COBRA coverage for up to 36 months. It’s important to note that you will be responsible for paying the entire premium for your COBRA coverage, including the portion that was previously paid by your employer, which can be expensive. Therefore, you may want to explore other options for health care coverage, such as under your spouse’s plan or through your state’s marketplace.

Should I rollover my 401(k)?

Whether you should roll over your 401(k) to an IRA depends on a number of factors including your goals, costs, and the investment options available in your plan. The investment options in a 401(k) plan are often limited, while an IRA offers a wider range of investment choices. An IRA may provide more flexibility in your investments. One may also want to consider a rollover for administrative convenience. A portfolio made up of several old employer plans may be difficult to monitor and manage compared to one consolidated IRA that is well-tracked.

Should I keep my company’s life insurance?

Many employers allow you to continue some or all of your group life insurance benefits. However, whether you should or not is a highly personalized choice. If you have health issues that could make it difficult to qualify for a new policy, continuing your existing benefit could be an attractive option. On the other hand, maintaining the former-employer coverage could be more expensive than purchasing a separate policy. You may also need to coordinate total benefits if a new job has a different life insurance offering to consider. Discussing all of these choices with your financial advisor can help ensure you have coverage your family needs with the right cost structure.

Whether you are uncertain about the future of your job or have been downsized, our checklist of Issues to Consider If You Lose Your Job summarizes cash flow, insurance, tax planning, asset, and debt issues to think about.

Additional Resources:

- How Much Should You Have In Your Emergency Fund?

- Watch The Real Deal Economy, where Director of Portfolio Management, Michael Waldron, likens the labor market to musical chairs and provides expectations for the future of the jobs market.