As wealth managers, we encourage individuals to use all of the available resources of capital to build their wealth. This includes using debt, when appropriate. Debt is an often misunderstood and misused source of capital. Some people avoid it while others overuse it. But, believe it or not, there are productive ways to use debt to help increase your wealth.

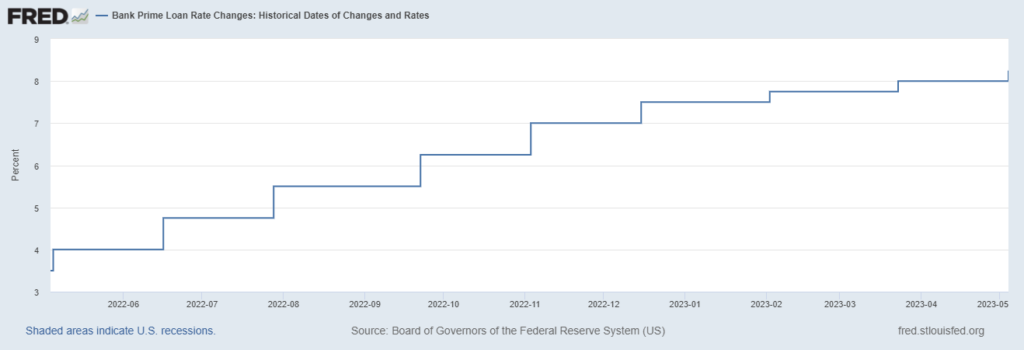

Though never “simple”, the past decade of record low interest rates made the decision-making process for taking on new debt and paying down debt fairly straight forward. In the most simplistic terms, you’d compare the interest rate on your debt with the return you expect to earn on your investments, putting your additional cash toward the option with the higher percentage rate. But with the cost of borrowing changing drastically over the past year the debt decision-making process has become more difficult. As the chart below illustrates, the Prime Rate (the interest rate that banks use as a basis to set rates for different types of loans, credit cards and lines of credit) more than doubled from 4% on May 5, 2022 to 8.25% on May 5, 2023.

In our Wealthy Behavior podcast episode, “New Rules for Using Debt to Build Wealth”, Heritage Financial President & CEO, Sammy Azzouz, and Ed Jastrem, Chief Planning Officer at Heritage Financial, discuss some guidelines for acquiring debt, paying down debt, and using it as a tool to build your wealth.

- Given that rates have increased dramatically over a short period of time, how should your views of debt change?

- Is the rule of thumb that you should retire with no debt still valid?

- How to determine whether you should pay debt off early or keep it.

Click the play (>) button below to hear the episode.

Or listen wherever you get your podcasts!

Additional Resources: