Key Observations

• Fitch downgraded the United States’ credit rating to AA+ from AAA at the start of the month.

• Market volatility continued through the month and most major asset classes experienced negative returns. Higher interest rates due to sentiment shifting to a “higher-for-longer” mentality by the Federal Reserve was a main culprit for weak performance.

• Commercial real estate has garnered a lot of headlines as the “next shoe to drop” but taking a deeper dive reveals the asset class may be more resilient than it appears on the surface.

August Market Recap

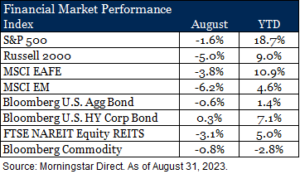

Every month this year has brought major events for investors to digest, and August was no different. The month started with Fitch downgrading the United States’ credit rating to AA+ from the top-quality AAA rating. The rating agency cited “rising debt burdens” and “erosion of governance” among the key drivers behind the decision.1 While this creates noise in the short-term, historically it has not impacted longer-term asset class returns. Ultimately, most asset classes did end the month lower. Rising rates were a main driver of the lackluster results across asset classes. Favorable economic data and more positive sentiment on the potential for a soft landing, coupled with a Federal Reserve that is willing to stay higher-for-longer, fueled the interest rate move higher.

Equities, which have seen valuations move higher through the course of the year due to expectations of potential Fed rate cuts by year end, re-priced in the month as that narrative shifted to the higher-for-longer story. The S&P 500 Index fell 1.6% in August. The “Magnificent 7” (Amazon, Apple, Alphabet, Meta, Microsoft, NVIDIA, and Tesla), which had been large drivers of the index year to date, had more muted impact as only three of the seven (Amazon, Alphabet, and NVIDIA) posted positive returns in the month. Markets outside the U.S. also took a step back in August as the MSCI EAFE Index and the MSCI EM Index returned -3.8% and -6.2%, respectively. Similar themes as the U.S. played out in developed markets (MSCI EAFE) and a strengthening U.S. dollar was an added headwind. Weakness in emerging markets was further compounded by poor results in China. Deflationary concerns, weakness in the real estate market, a slower reopening from COVID-19 restrictions, and underwhelming economic activity have contributed to poor sentiment for the country.

Fixed income markets were more directly impacted by rising rates (bond prices move inversely to interest rates) with the Bloomberg U.S. Aggregate Bond Index returning -0.6%. The U.S. 10-year Treasury yield touched 4.3% during the month before settling in at 4.1%. The less rate-sensitive corporate high yield market produced a modest positive return (+0.3%) with spreads tightening following an initial widening after the U.S. downgrade. Real assets, such as commodities and REITs, declined as well. Within commodities, industrial metals were a weak point while retail and lodging were underperformers in the REIT market. The office component held up better than other sub-sectors despite the unfavorable headlines the sector has been garnering this year.

Commercial Real Estate – The Next Shoe to Drop?

The commercial real estate market, and in particular the office sub-sector, has fallen into the crosshairs this year. Interest rate hikes by the Federal Reserve and higher borrowing costs, fears of an economic slowdown, and the regional banking crisis earlier in the year have all been drivers of the pessimism. On the surface, these factors warrant negative sentiment, but if we dive a bit deeper the asset class may be more resilient than headlines suggest.

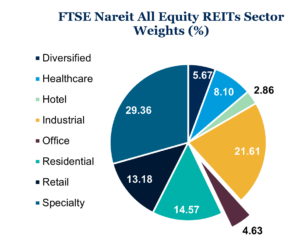

The post-pandemic hybrid and work-from-home environment has pressured the office market as investors ponder the uncertainty of future demand. However, the office sector accounts for only a fraction of the real estate market. Office is less than five percent of the publicly traded REIT market. The private real estate market has a larger weight to office (approximately 23 percent2). Despite the larger exposure on the private side, not all office properties are created equal. Medical office and Life Science office have been resilient. Fundamentals in other areas of the commercial real estate market remain favorable as well, with occupancy rates above 90 percent and positive year-over-year rent growth.3

The post-pandemic hybrid and work-from-home environment has pressured the office market as investors ponder the uncertainty of future demand. However, the office sector accounts for only a fraction of the real estate market. Office is less than five percent of the publicly traded REIT market. The private real estate market has a larger weight to office (approximately 23 percent2). Despite the larger exposure on the private side, not all office properties are created equal. Medical office and Life Science office have been resilient. Fundamentals in other areas of the commercial real estate market remain favorable as well, with occupancy rates above 90 percent and positive year-over-year rent growth.3

Central bank action and higher interest rates have resulted in more expensive borrowing costs and higher discount rates. Coupled with concerns of a slowing economy, this has led to worries of refinancing debt. While this environment does create headwinds for maturing real estate debt, only 16 percent of the market is maturing in 2023 and office is only 4.2 percent of the total debt coming due this year. Additionally, leverage levels are below the historical average, which should help insulate properties compared to past cycles if we see further softening in the market.

The collapse of Silicon Valley Bank and the subsequent fallout in the regional banking sector sparked concern for the commercial real estate market as well, with the office sector being in focus once again. The majority of loans come from various lender types such as agency MBS, CMBS, CDOs, and life insurance companies, while regional banks only account for 32 percent of the loans issued in the commercial real estate market.4 These loans are widely spread over 4,000 regional and community banks so the fallout of a few would likely have minimal impact on the entire market.

The commercial real estate market has come under pressure, and we may continue to see pockets of weakness in the near term. However, the asset class may be more resilient than headlines suggest as broader fundamentals remain healthy across a variety of property types, reginal banks’ commercial real estate exposure is overstated, and the office sector is just a small piece of the overall market.

Outlook

Despite the market struggling in August, the broader economic backdrop remains resilient. The Federal Reserve, as we have been hinting, is likely close to the end of the hiking cycle, as inflation has moderated from multi-decade highs. While volatility may continue, we believe portfolio allocations are thoughtfully constructed to provide resiliency and positioned to help investors meet long-term objectives in a variety of market scenarios.

1. Fitch. As of August 1, 2023. https://www.fitchratings.com/research/sovereigns/fitch-downgrades-united-states-long-term-ratings-to-aa-from-aaa-outlook-stable-01-08-2023.

2. NCREIF. As of March 31, 2023.

3. NCREIF, Barings. As of March 31, 2023.

4. Mortgage Bankers Association, Cohen & Steers, NCREIF. As of March 10, 2023.