(The following was originally shared with clients of Heritage Financial on February 24, 2022.)

Global equity markets have been volatile since the start of 2022 as investors question overall valuations, the trajectory of interest rates, and emerging geopolitical events. Over the last few days, geopolitical risk has become the most pressing risk for global markets, as Russia has initiated an invasion of Ukraine. In this volatile time, we want to update you with more specifics surrounding current events, the impact of those events on markets, and what portfolio adjustments we may make.

Before jumping in, it’s worth mentioning that communications decisions during times like this can be challenging philosophically for wealth managers. We know our clients have questions and concerns and we want to help you navigate volatile markets, while not deviating from fundamental tenets of successful investing. Enduring periodic times of high market volatility and unexpected negative events have historically been normal aspects of a functioning market. And true financial reward is ultimately delivered to those who maintain a disciplined long term investment strategy, especially in the face of adversity. With that as background, let’s dig in.

What’s Happening?

Overnight, Russia launched a series of coordinated attacks on key military targets across Ukraine, including air, ground, and amphibious assaults. The official line states Russia is invading to protect Russian citizens, especially those in the self-proclaimed Russian republics of Donetsk and Luhansk who declared such independence in 2014 when Russia last invaded Ukraine. However, Russian interests go much deeper. The collapse of the Soviet Union in 1991 left Russia vastly depleted from its former days of empire building.

Impact on Global Markets

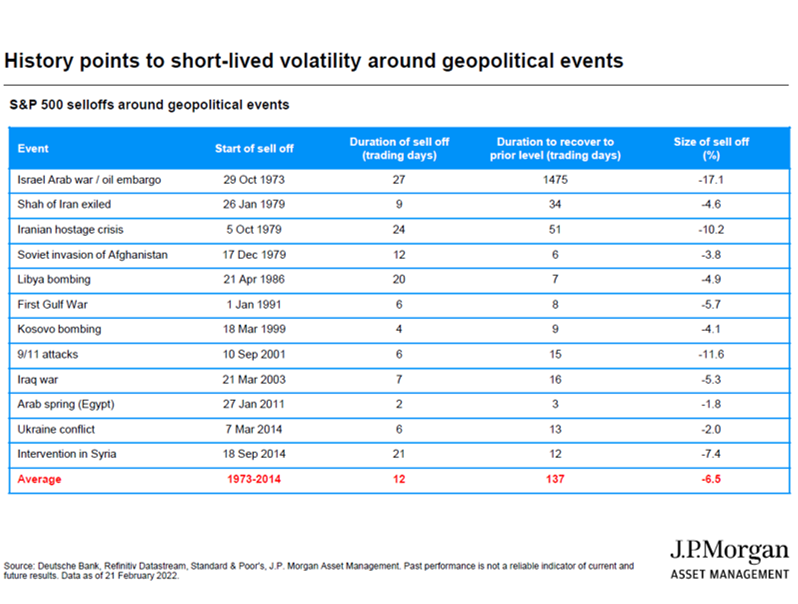

Regardless of the driving force behind the invasion, equity markets are reacting negatively. To be clear, it has been a volatile start to the year. As we mentioned previously, investors have been weighing more than just geopolitical concerns. With U.S. markets up roughly 100% from the start of the last bull market in March of 2020 through the end of last year, valuations – particularly for growth stocks – have been in question for many investors. Markets have also been digesting the Fed’s plans to raise interest rates beginning next month. And tensions have been running high with the Russian build-up of forces outside Ukraine in the news for months. With all of this to consider, global stocks (i.e., the MSCI All Country World Index) were down nearly 9% year-to-date prior to last night’s invasion of Ukraine, and down more than 12% from their 52-week high. U.S. stocks are 13% off their 52-week high.

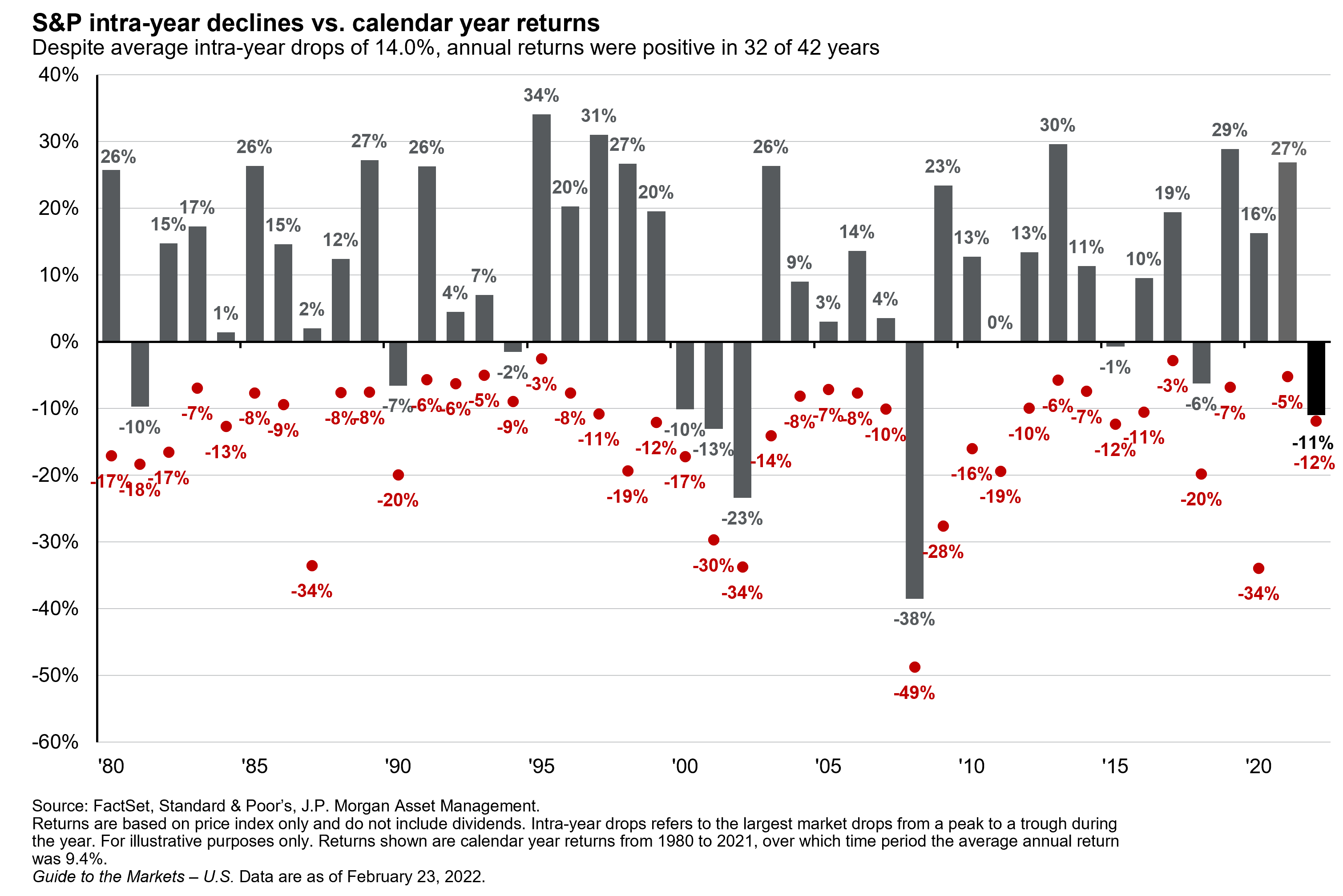

Perspective is important in times of uncertainty. As you can see in the chart below, over the past 40 years the average intra-year U.S. stock market pullback has been -13.8%, right around current levels. Said another way, the decline in stocks we’ve seen over the past several months is, so far, “typical”.

Of course, things could get worse before they get better. War is unpredictable. But as investors we must also consider other alternatives. For example:

Of course, things could get worse before they get better. War is unpredictable. But as investors we must also consider other alternatives. For example:

- The threat of higher interest rates, which also bears some responsibility for negative year-to-date returns, is likely fully priced into current market levels. The invasion of Ukraine probably has an interesting dual effect on the Fed’s actions over the next few months. On the one hand, it may add fuel to the fire of inflation with higher energy prices. On the other, the environment of greater uncertainty provides the Fed some flexibility to move at a more modest pace with the tightening of monetary policy if they so choose.

- It’s also worth asking the logical question of exactly how Russia’s invasion of Ukraine impacts the earnings of companies around the world. It’s important to remember that the value of any stock is simply the present value of all future cash flows (i.e., earnings/dividends). For the majority of companies, this event will have little to no long-term impact on future earnings. While it’s difficult to imagine that the impact on markets of this unfortunate humanitarian event could be minor, for long-term investors, this is likely the case.

Potential Adjustments to Your Portfolio

We cannot predict what happens next with the Russia/Ukraine conflict and the impact that it may have on the global economy and markets, nor do we think anyone else can. We do know that stock markets are a leading indicator of future economic activity, which simply means that they move in anticipation of economic events down the road and not after they have been confirmed. They are susceptible to shocks that create immediate uncertainty, but such overreactions typically correct themselves in short order as clarity emerges.

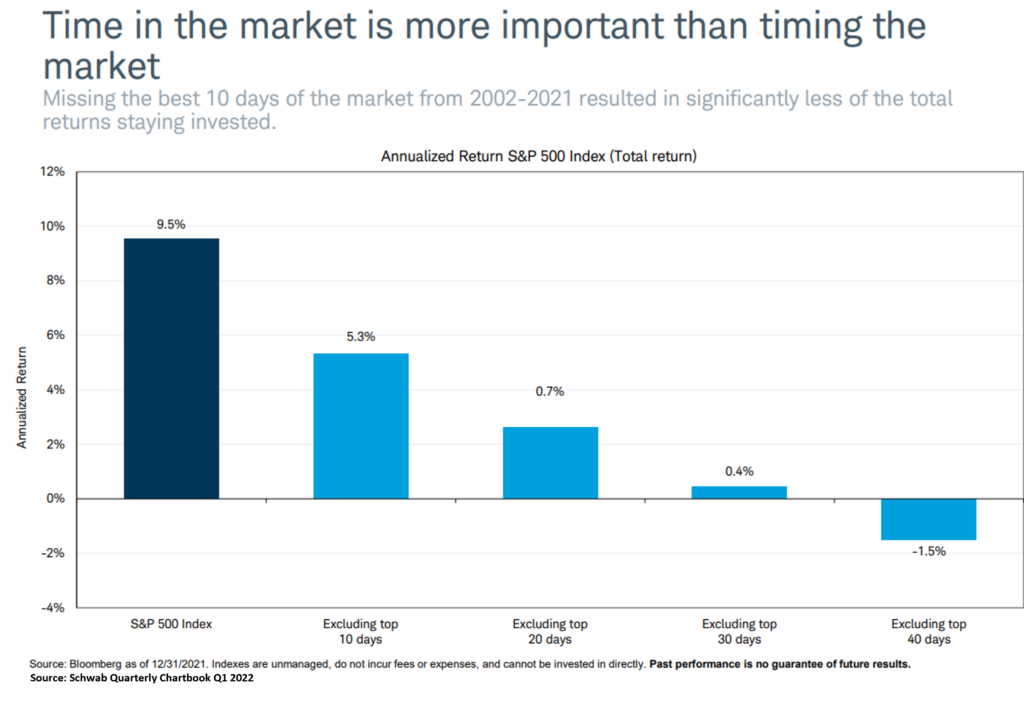

As a result, we don’t try to time the markets in an attempt to avoid short-term declines since determining when to optimally buy or sell is a fool’s game. We strongly believe that it’s time in the market, not timing the market, that delivers the best long-term results.

As a result, we don’t try to time the markets in an attempt to avoid short-term declines since determining when to optimally buy or sell is a fool’s game. We strongly believe that it’s time in the market, not timing the market, that delivers the best long-term results.

Instead, we build long-term investment strategies to stand the test of time after clearly understanding your financial situation, and most importantly, when you will need to withdraw assets from your portfolio and in what amounts. The asset allocation and design of your portfolio was structured to avoid having to sell a meaningful amount of equities at a loss when markets decline to meet your spending needs. When the stock market is down, we generally withdraw from other asset classes to fulfill your short and intermediate cash flow needs and allow your stocks the opportunity to recover from corrections or bear markets. It’s times like these where diversification plays an important role and it’s nice to have a multi-asset class portfolio when facing withdrawal needs. And in our professional view, discipline is of utmost importance in times like these.

Instead, we build long-term investment strategies to stand the test of time after clearly understanding your financial situation, and most importantly, when you will need to withdraw assets from your portfolio and in what amounts. The asset allocation and design of your portfolio was structured to avoid having to sell a meaningful amount of equities at a loss when markets decline to meet your spending needs. When the stock market is down, we generally withdraw from other asset classes to fulfill your short and intermediate cash flow needs and allow your stocks the opportunity to recover from corrections or bear markets. It’s times like these where diversification plays an important role and it’s nice to have a multi-asset class portfolio when facing withdrawal needs. And in our professional view, discipline is of utmost importance in times like these.

As we see it, there are three paths for investors to consider:

1. Reduce risk to limit losses assuming markets continue to decline

2. Increase risk by buying assets at cheaper prices

3. Stay the course, consistent with a long-term strategic approach

There are pros and cons to each option.

Option #1: Reduce Risk to Limit Losses

At Heritage, we believe our clients’ portfolios already have enough protection in place so additional risk reduction is typically not necessary. The diversification we employ reduces risk from any single equity market and we do not maintain concentrated portfolio positions. Additionally, taking the path of risk reduction comes with an opportunity cost, because at some point, markets will rebound and investors could be left with too conservative an allocation, causing them to miss part of the recovery.

Option #2: Increase Risk to Buy Assets at Cheaper Prices

“Buying low” is a great way to make money long term, which makes this option tempting. However, if investors increase risk too early, it could exacerbate losses on a greater decline. Good investors, with a diversified portfolio, frequently choose this path, but the hard part is determining exactly at what level to increase risk. We will discuss this option further below.

Option #3: Stay the Course

This reflects the strength of a long term prudent and successful investment plan. It historically works, since markets have rewarded patient, disciplined investors who accept the ups and downs of the markets while strategically rebalancing their portfolio when opportunities arise.

What guides Heritage’s investment strategy in these circumstances?

We choose a combination of options #2 and #3. We don’t want to jump into a modest decline, such as an average calendar year -14% “correction”. However, when you get to a more substantial pullback or bear market, such as a 20% to 30% drop, these have historically presented excellent buying opportunities. At these levels, you will rarely regret adding to equities with a long-term perspective. As in the past, we regard a 20% decline from the top in the U.S. or global stock markets as an attractive opportunity to add stocks to your portfolio while reducing exposure to bonds and/or alternative investments. This could happen by a combination of rebalancing the portfolio back to its initial target weights and increasing the target allocation to stocks. The extent of the buying opportunity will be dependent on the severity of the decline, and we have internal triggers in place to take advantage of these opportunities if they arise.

At Heritage, we aim to deliver sensible and prudent investment strategies to stand the test of time while accounting for inevitable market declines. We’re here to help you look past the short-term headlines and noise in the media that can sidetrack non-disciplined investors and instead focus on meeting your financial planning goals and achieving sound long-term investment results. We will continue to monitor daily market moves and implement changes in your portfolio as appropriate.