January marks political and market shifts in leadership

Key Observations

- Markets Adapt to Policy Shifts – President Trump’s executive orders kept investors on edge, but his position on tariffs provided a tailwind for international markets.

- NVIDIA’s Wake-Up Call – A 17% drop in NVIDIA shares, triggered by AI competition from China, highlights the risks of market concentration and stocks priced for perfection.

- The Fed Holds Steady – With solid GDP growth and low unemployment, the Fed left rates unchanged, signaling caution rather than a rush to ease policy.

- Tariffs are an Inflation Wild Card – While tariffs could push prices higher, history also shows they are just one piece of a larger economic puzzle.

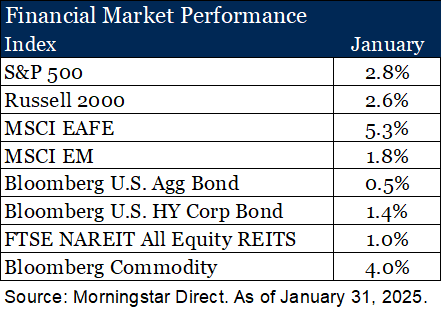

Market Recap

January marks both symbolic and literal new beginnings. President Trump took office on January 20, swiftly issuing a flurry of executive orders that kept investors scrambling to assess their implications. The notable absence of tariffs—our deep dive topic for the month—helped propel international markets higher. Markets, as forward-looking discounting mechanisms, had already priced in much of the tariff-related rhetoric during the fourth quarter. The absence of new developments acted as a relief valve for investors with acute concerns.

Another key driver of U.S. versus international market performance in January was NVIDIA. Shares of NVIDIA fell nearly 17% on January 27, accounting for 79% of the S&P 500’s one-day decline (-1.15% of the index’s -1.45%. drop).1 The sell-off was triggered by news that Chinese startup DeepSeek had developed an AI model with quality comparable to U.S. models but with significantly lower capital investment and reduced need for advanced computing power—an implicit challenge to demand for NVIDIA products. For years, investors have grown accustomed to market concentration fueling U.S. equity returns. However, as we highlighted in our annual outlook, concentration also carries risks. Whether DeepSeek represents a “Minsky moment” for AI is beyond our remit, but this episode underscores the theme of fragility we noted in our outlook.

On the economic front, the Federal Reserve left interest rates unchanged in January and notably removed its standard language on improving inflation dynamics. With unemployment hovering around 4% and fourth quarter 2024 GDP reported in January at 2.3%2, the economy has little slack to absorb pro-growth policies without adding inflationary pressures. As a result, the Fed lacks both the motivation (a weakening economy) and the visibility (policy clarity) to pursue further easing at this time.

Historical Fed minutes—released with a five-year lag—reveal that policymakers in 2018 and 2019 prospectively discussed the economic impact from the Trump tariff policies when considering monetary policy. This latest decision aligns with our view that inflation risks remain elevated, reinforcing our portfolio positioning for 2025 and beyond.

Tariff Talk

Although tariffs were absent from the flurry of executive orders in January, February brought new developments, with Canada, Mexico, and China now in the spotlight. While the situation remains fluid we’ll take this is as an opportunity to put tariffs into context and examine their potential impact.

A Historical Perspective

President Trump is not pioneering new territory here. While modern tariffs, including those implemented in 2018 and 2020, have played a modest role in economic policy, tariffs have had a more prominent role historically. In the past they have been used to attempt economic fairness (with “fairness” being subject to interpretation), protect domestic industries and generate government revenue.

Recent tariff supporters who face critisim of inflation often dust off history books and point to the Smoot-Hawley Tariffs of the 1930s as evidence that tariffs alone are not inflationary. It is true that the taxation of over 20,000 goods—leading to an effective tariff of ~20%—coincided with flat or even moderating CPI levels3. But let’s not forget the broader economic backdrop: the U.S. was in the depths of the Great Depression, with the economy contracting sharply. Hardly the definitive proof one might hope for.

Fast forward to modern times. The tariffs imposed during Trump’s first administration in 2018 and expanded by President Biden in 2020 coincided with inflation surging from multi-decade averages of ~3% to over 9% by 20224. Other prevailing economic factors were also at play during that period. The government responded to the COVID-19 pandemic by dramatically expanding the money supply, keeping interest rates at historic lows, continuing quantitative easing until March 2022, rolling out massive fiscal stimulus and running up deficit spending (which continues today). Tariffs were just one piece of a much larger inflationary puzzle.

The Economic Punchline

Basic economic principles suggest tariffs are inherently inflationary. Why? Even without retaliatory tariffs—which we think are likely—companies facing higher input costs will pass those increases on to consumers. That translates to higher prices and, in effect, is policy-manufactured inflation. However, the actual inflationary impact depends on broader economic conditions, as demonstrated by history.

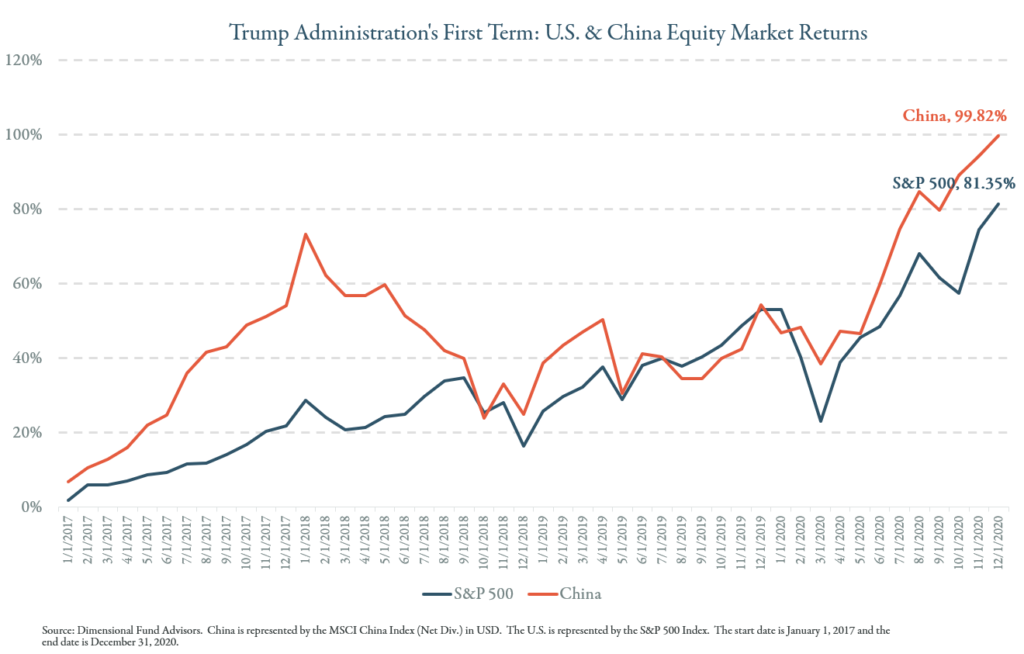

Perhaps surprisingly, despite all the back and forth about tariffs between China and the U.S. during President Trump’s first term, China posted higher cumulative returns than the U.S. over the four years of Trump’s term.

What This Means for 2025

- Tariffs Raise Inflation Risks—But Aren’t the Only Factor – As we outlined in our 2025 Outlook – Bridging the Divide, the risk of accelerating inflation has increased for numerous reasons. If tariffs are enacted, the extent and scope will likely add upward pressure on prices. However, they won’t be the sole driver of inflation.

- Tariff Impacts Tend to Be Temporary, Not Structural – Just as tariffs can be imposed quickly, they can be reversed just as fast. Long-term investors are likely to see greater success by focusing on fundamental drivers—valuations, earnings growth and diversification to name a few—rather than short-term policy moves.

- Expect Noise – Tariffs are often used as a bargaining tool rather than purely an economic policy. Take Colombia, for example. In a recent headline-grabbing episode, the new administration sought to deport migrants back to their home country. When Colombia initially resisted, a brief standoff ensued, involving tariff threats. After a few deportation flights landed, the tariff threats disappeared. The new administration has shown far greater willingness to use these tactics than in the recent past. We expect more of these episodes which could create short-term market volatility. For long-term investors, such moments often present opportunities rather than fundamental shifts.

Looking Ahead

The start of the year has offered many opportunities to shift our investment focus from the long term to the short term, reacting to market fluctuations and headlines. However, our investment strategy remains the same—looking beyond headline-driven noise to allocate capital where we see the most compelling long-term returns. For more on our 2025 positioning, see our annual outlook, Bridging the Divide.

1. Morningstar as of January 29, 2025

2. Bureau of Labor Statistics Consumer Price Index as of January 15, 2025

3.The Peterson Institute as of December 31, 2024

4.Bureau of Economic Analysis Advanced Estimate of 4Q GDP as of January 30, 2025