The Internal Revenue Service announced annual inflation-adjusted changes to tax brackets, annual exclusions for gift and estate taxes, FSA limits, and more for 2024. Though the tax bracket adjustment of 5.4% is lower than the 7.1% increase in 2023, it is higher than the current rate of inflation and will be welcomed by most Americans. We’ve provided a few highlights of the release below. More detail on all the IRS tax inflation adjustments for 2024 can be found at www.irs.gov.

- The standard deduction for married couples filing jointly for tax year 2024 rises to $29,200, an increase of $1,500 from tax year 2023. For single taxpayers and married individuals filing separately, the standard deduction rises to $14,600 for 2024, an increase of $750 from 2023; and for heads of households, the standard deduction will be $21,900 for tax year 2024, an increase of $1,100 from the amount for tax year 2023.

- Estates of decedents who die during 2024 have a basic exclusion amount of $13,610,000, increased from $12,920,000 for estates of decedents who died in 2023.

- The annual exclusion for gifts increases to $18,000 for calendar year 2024, increased from $17,000 for calendar year 2023.

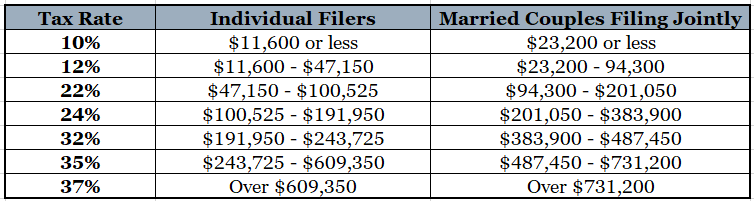

- Tax rates remain unchanged; however, the income limit for each tax bracket has changed, meaning more of your income may fall in a lower tax bracket.

In addition to tax savings, the IRS also adjusted the contribution limits to retirement accounts, Health Savings Accounts, and Flexible Spending Accounts. Click the link below for a consolidated summary of all the changes and limits individuals and business owners need to know for 2024.

2024 Important Dates and Financial Figures

Keeping up with the constant tax changes can be difficult and time consuming. It’s never too early to start tax planning so you can keep as much of your hard earned dollars as possible.