The practice of investing early and often is just as important, if not more, for women than for their male counterparts—why you ask?

Relative to men, women generally:

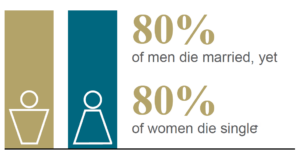

- Have a longer life expectancy

- Tend to work fewer years

- Are less likely to get remarried after divorce or widowed

- Rely more on social security, but often receive less in benefits1

- Feel less confident about their financial knowledge and take less risk in investing2

Yet, women are a powerful force in the economy:

- Controlling 75% of the discretionary spending Worldwide3

- Overseeing 51% of the personal wealth in the U.S. (~$22 trillion)4

- Earning the majority of college degrees5

- Owning ~40% of businesses in the U.S.6

Women have made great strides in financial independence. But overcoming systemic hurdles must be deliberate. Here are five strategies and how Heritage can help.

1. Be as detailed as possible about your vision for retirement

How do you picture your retirement? Do you want to retire early, travel, take up hobbies, buy a second home, start a charity, fund a family vacation? While it’s tempting to boil it all down to a number – how much you’ll need to retire comfortably – for many women it’s much more motivating to attach tangible goals, values, aspirations, and a vision to what you want to experience. If a vision board has helped you get focused and productive in other areas of your life, it can be powerful in financial planning as well.

At Heritage, your goals are our starting point. We get to know you before you become a client of ours through a detailed three-meeting process that begins with a one-hour discovery session that dives deep into your mission, vision, values, and goals. We don’t get deep into investment discussions until our third meeting, once we have a good handle on your goals and a potential plan.

2. Prioritize saving for health care

A longer life expectancy means greater health care costs and long-term care costs. According to the Fidelity Retiree Health Care Cost Estimate, a single person aged 65 in 2023 may need approximately $157,500 saved (after tax) to cover health care expenses in retirement. An average retired couple age 65 in 2023 may need approximately $315,000 saved7. These estimates do not include annual costs for long-term care.

At Heritage, we incorporate higher inflation assumptions for health care expenses as we model out how well your projected savings will cover a realistic version of your future expenses. Our modeling capabilities allow us to stress-test several “what-if” scenarios, including the potential need for long-term care expenses. This allows us to brainstorm ways to mitigate these risks well in advance.

3. Keep saving even if you aren’t working

A couple can save for retirement together, even if one of them doesn’t have their own income. A Spousal IRA allows a working spouse to contribute to an IRA on behalf of a non-working or low-earning spouse. The maximum amount that can be contributed is $6,500 in 2023 or $7,500 for individuals age 50 or older. Think the numbers are too small to matter? Just five years of being out of the workforce but contributing $6,500 into a Spousal IRA can grow to more than $200,000 over 25 years, assuming a 7% rate of return.

At Heritage, we identify options for making tax-favored retirement contributions based on your specific situation and how your financial picture changes from one year to the next. If you suddenly become eligible for a Spousal IRA, we’ll help determine how much you can contribute. We monitor contribution limits and rules to help you keep more of what you earn, minimize taxes, and save for the future, no matter how your life shifts over time.

4. Coordinate social security planning with your partner

As a woman, you are more likely to take time off during your working years to care for children or aging parents. Unfortunately, this time off and loss of income can negatively affect your future social security benefit. But there are strategies to combat this, and it helps to be aware of these strategies whether retirement is decades away or right around the corner.

At Heritage, we help our clients make decisions about social security benefit strategies early. For married couples, we compare the social security benefits of both spouses and strategize ways to maximize their combined benefit over both of their lifetimes. Often this means that the spouse with the higher benefit (typically the husband) delays their benefit beyond Full Retirement Age in order to increase their benefit so that the surviving spouse (typically the wife) can have a strong benefit upon the spouses passing.

Wondering if you are doing what you can to maximize your future social security benefits? Join our next webinar to find out.

Social Security Administration, Social Security Fact Sheet. July 2019. Data for 2017.

5. Get involved now

Women tend to live longer (average life expectancy of 79 vs 73 for men, according to the CDC) and stay single after losing a spouse, so it’s likely that eventually they will be solely in control of their wealth. The world of finance can be intimidating and while today it may seem easiest to turn a blind eye and let someone else handle your finances, your future-self may regret that decision. It is important to understand your financial plan, be familiar with your assets, net worth statement, and location of accounts. Staying involved will help you feel confident so that should you become solely responsible for your finances, you’ll know that your investment, insurance, estate, and tax situations are in good order.

Journal of Financial Service Professionals, “Widows’ Voices: The Value of Financial Planning,” January 2016.

At Heritage, we project your financial plan out well past average life expectancy to address longevity risk. One of the greatest fears women have is that they’ll run out of money. The more years of living that you plan for, the less likely it is to happen.

We also strongly encourage both spouses to attend all meetings with us. Since the pandemic, the number of virtual meetings has increased which has made it easier to keep both spouses involved in the finances. We like to get to know both spouses well so we can understand their respective goals, risk tolerance level, and beliefs which helps us provide more individualized, actionable advice.

Ready to get more involved or to get started on building your future? Your Heritage wealth management team will help educate and empower you so you can live the life you dreamed.

1. Social Security Administration, Social Security Fact Sheet. July 2019. Data for 2017.

2. How Financially Literate Are Women? An Overview And New Insights, Bucher Koenen, updated for 2017.

3. EY, “Harnessing the power of women investors in wealth management,” 2018.

4. WEALTHTRACK, “51% of personal wealth in the US is controlled by women,” June 28, 2019.

5. US Department of Education , The Condition of Education, 2019.

6. OnWallStreet.com, “Advisors’ dilemma: Women less engaged, more negative toward financial planning,” Charles Paikert, March 5, 2020.

7. https://www.fidelity.com/viewpoints/personal-finance/plan-for-rising-health-care-costs