Have you ever reviewed your credit card statement and noticed a big jump in the amount owed? Your first thought might be that you’ve been hacked as you rush through the statement to see what has been charged to your account. A sense of relief might be experienced as you discover that you haven’t been hacked, you’ve just been assessed your credit card’s annual fee. This realization can also leave a sour taste in your mouth as you start to wonder what your options are so that you don’t have to pay another annual fee. The good news is that there are options available to investigate if you want to try and skirt paying that credit card annual fee.

Ask for a fee reduction or waiver

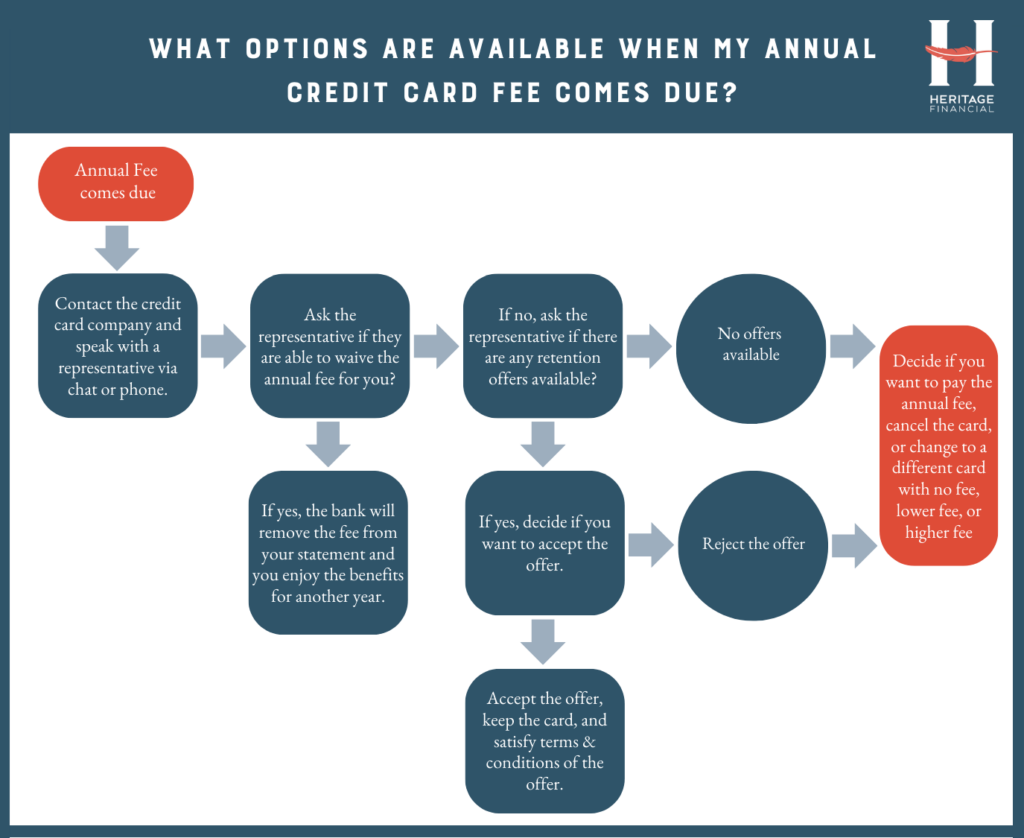

While banks may not waive fees every time you ask them to, it certainly doesn’t hurt to give them a call once the fee has posted to your account and see if they will (especially if you are a member of the military). The worst they can say is no. If you do get a no, tell the representative that you are considering closing your card and ask them if there are any retention offers available. Sometimes the bank may offer you an annual fee reduction/waiver, bonus points or miles, or a statement credit to entice you to keep your card. Pay attention to the terms and conditions of any offer they give you, as the offer may require a set amount of spending over a specific period of time (i.e. $2k of spend in the next three months).

When asking for a retention offer, it’s very important that you say you are considering closing your account instead of outright saying that you want to cancel your card. If you tell the bank that you want to cancel your card, they will cancel it and you might lose out on a card that you really wanted to keep.

What if the bank doesn’t have a retention offer for you or you don’t like the one that they offer?

While your chances are fleeting at this point, the good news is that you do have a few more options available. Instead of outright cancelling the card, you can ask the representative about making a product change and switching to a new card that doesn’t have an annual fee, has a lower fee, or in some cases a higher fee. One thing to be wary of when making a product change is that some banks won’t allow you to get a new sign-up bonus on a card that you’ve owned before. So if the card you switch to is one that typically has a good sign-up bonus, you may not qualify for it on a future application.

One last option for those in “two player mode” is to try referring someone else living in your house to the card you are looking to downgrade. If that person gets approved, they could earn a new sign-up bonus and you could potentially earn a referral bonus before you decide to downgrade or cancel your card. Yes, the other person will end up having to pay the annual fee, but in most cases the sign-up bonus and potentially a referral bonus more than make up for the cost of the annual fee.

Related Articles: