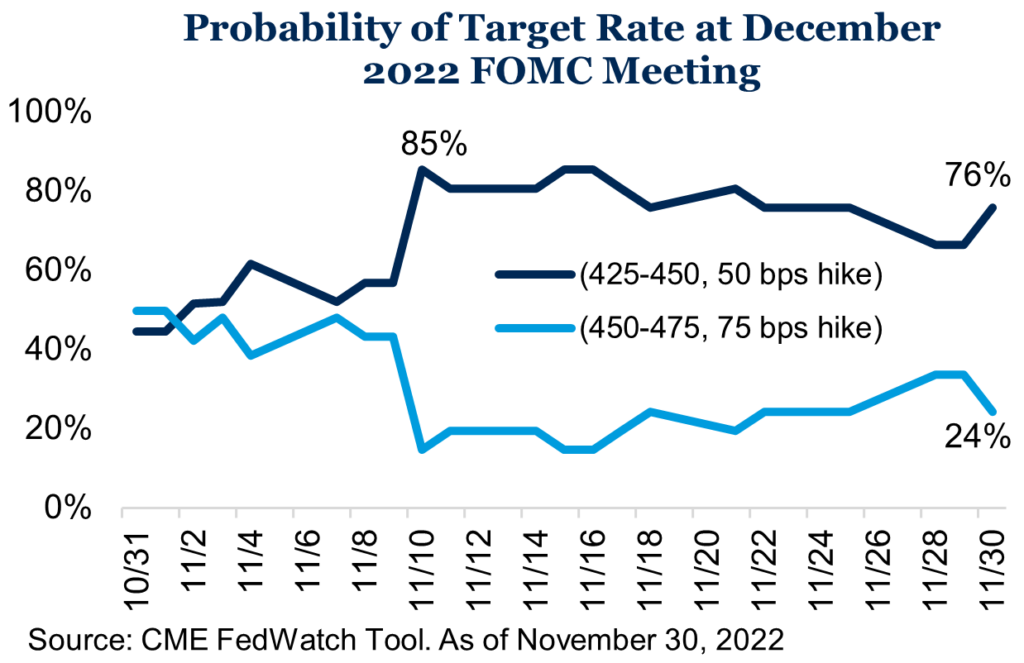

The October inflation report marked a turning point in investor sentiment. U.S. CPI grew 7.7 percent year-over-year in October. While still elevated, the print came in below expectations and marks the lowest reading since January. Investors pivoted to the “Fed pause” narrative, sending the S&P 500 Index up 5.6 percent on November 10th, making it among the top trading days on record*. Expectations for a moderating Federal Reserve soared, with the market shifting to an 85 percent probability of a 50 basis points rate hike in December rather than a 75 basis point hike**. Markets are also pricing in a pause in the rate hike campaign in 2023. As our CIO, Bob Weisse, discussed on our most recent Wealthy Behavior podcast episode, the Fed remains committed to being in a “higher for longer” mindset, but the statement coming out of the November Fed meeting lends some credence to the possibility of a pause in 2023 as the committee accounts for the “lags with which monetary policy affects economic activity and inflation.”

Inflation expectations have moved lower as investors digested the recent CPI report and Fed messaging. This pushed rates on the long end of the U.S. yield curve lower and, based on the difference between the 10-year and 2-year Treasury yields, the curve is now the most inverted it has been since the 1980s (touching -77 basis points during the month)***. An inverted yield curve has historically been a warning sign of recession to come, and the Fed has made it clear they are willing to sacrifice growth to bring down inflation. We are starting to see signs of slowing activity – PMI numbers moderating, housing data softening, etc. – but the U.S. labor market remains resilient, consumer balance sheets are generally in favorable positions and the Bureau of Economic Analysis reported Q3 2022 GDP growth of 2.9 percent in its second estimate. It remains to be seen if the Fed can navigate a “soft landing” in the new year.

The Federal Reserve and its commitment to fight inflation remains at the forefront of the investment discussion. Recent inflation data is showing signs the worst may be behind us and the possibility of a central bank pause in 2023 breathed life into financial markets in November, but some of those gains have been reversed in early December. Choppiness in stock returns highlights that risks lurk on the horizon and the chance of recession in the next year is probably elevated. All in all, financial conditions have moved tighter since the beginning of the year, inflation, while slowing, remains very high and geopolitical risks persist around the world. As we head into year-end we are busy finalizing our forthcoming 2023 investment outlook, but we remain steadfast in our view that taking a strategic and disciplined approach to investing allows for the highest probability of achieving long-term investment objectives.

- We reiterate these views, and more, in our Wealthy Behavior podcast “Does The Fed See What We See?”

Sources:

* Morningstar Direct. As of November 30, 2022

**CME FedWatch Tool. As of November 30, 2022

***FactSet. As of November 30, 2022