Compounding has long been celebrated as a cornerstone of successful investing. The power of compounding is more than just an investment principle; it is a strategic approach to growing your wealth exponentially over time, helping you achieve financial independence and long-term security.

The concept goes beyond simple returns, demonstrating how reinvested earnings can create a snowball effect that builds momentum with each passing year. Below, we explore what compounding is, why time is its greatest ally and how individual investors can leverage it to help meet their financial goals.

What is Compounding?

At its core, compounding occurs when the returns on an investment generate additional returns over time. This process allows your money to grow at an accelerating rate, as interest or investment earnings begin to earn returns themselves, creating a snowball effect.

For example, let’s assume you invest $10,000 in an account that earns a 6% annual return. In the first year, your investment grows to $10,600. In the second year, you earn 6% not just on the original $10,000 but also on the $600 earned in year one. Over time, this exponential growth becomes increasingly significant.

Why Time Is Essential

Time is the single most critical factor in compounding. The earlier you start investing, the more opportunities you give your money to grow.1 This is because compounding requires patience to unlock its full potential.

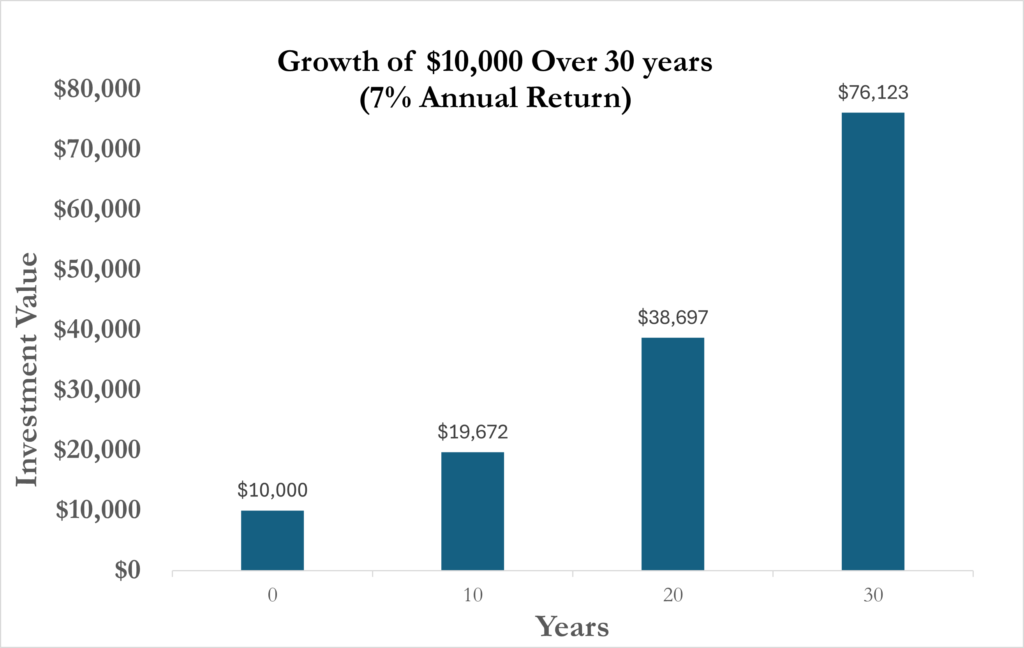

This chart highlights how the pace of growth accelerates as time progresses, underscoring the importance of starting early.2

For illustrative purposes only.

The Cost of Waiting

Procrastination can be costly when it comes to compounding. For every year you delay investing, you reduce the potential growth of your portfolio. For instance, a $10,000 investment earning 7% annually grows to approximately $76,123 in 30 years. Waiting just five years to invest reduces the ending balance to $53,865—a difference of over $22,000.2

How to Harness the Power of Compounding

1. Start Early

The earlier you start investing, the better. Even modest contributions made consistently over a long period can grow to significant sums. For example, investing $100 per month starting at age 25 can result in over $190,000 by age 65 at a 7% annual return—far exceeding the total contributions of $48,000.2,3

2. Reinvest Returns

To take full advantage of compounding, reinvest your earnings rather than withdrawing them. This applies to interest, dividends, and capital gains. Many investment vehicles, such as dividend reinvestment plans (DRIPs), make this process automatic4,5

3. Stay Consistent

Market volatility can tempt investors to stop contributing or withdraw during downturns. However, consistency is key to long-term success.

4. Choose the Right Investment Vehicle

Tax-advantaged accounts such as IRAs and 401(k)s can supercharge compounding by minimizing tax drag. Without taxes eating into annual returns, your investments grow faster. Ensure your portfolio is diversified and aligned with your risk tolerance to balance growth and protection.

Take the Next Step in Growing Your Wealth

Understanding the power of compound interest is just the beginning. A well-structured financial plan ensures that your investments align with your long-term goals, risk tolerance, and evolving life circumstances. At Heritage, we help clients build personalized strategies for growing and preserving wealth. Whether you’re just getting started or looking to refine your portfolio, our advisors can guide you through the next steps. Remember, the best time to start investing was yesterday; the second-best time is now.

In the spirit of Financial Literacy Month, share this key principle of successful investing with others. By consistently investing over time, you can turn small contributions into significant financial growth. That’s the power of compounding.

- [1] Beginners’ Guide to Asset Allocation, Diversification, and Rebalancing | Investor.gov

- [2] Compound Interest Calculator | Investor.gov

- [3] Beginners’ Guide to Asset Allocation, Diversification, and Rebalancing | Investor.gov

- [4] Dollar cost averaging | Fidelity. May 6, 2024

- [5] When to Reinvest Dividends (or Not) | Morningstar. May 17, 2024